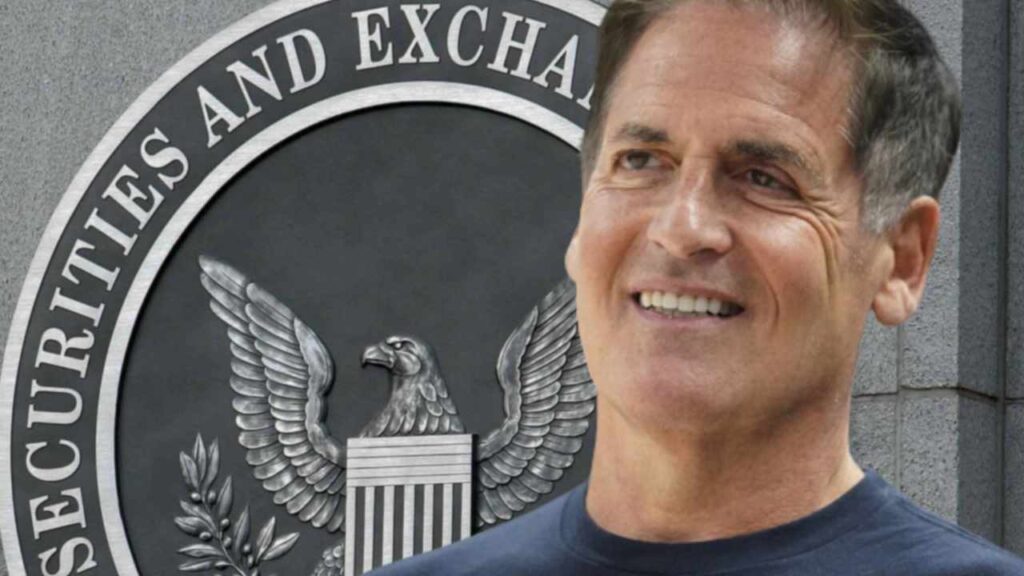

Mark Cuban, a Shark Tank star and owner of the NBA team Dallas Mavericks, has slammed the U.S. Securities and Exchange Commission (SEC) for taking a wrong approach to regulating the crypto industry. “The SEC is not infallible. It makes mistakes,” the billionaire stressed, adding that if the SEC had taken a similar approach to Japan, no one in the U.S. would have lost money when the crypto exchange FTX collapsed.

Mark Cuban Criticizes SEC and US Crypto Regulation

Shark Tank star and the owner of the NBA team Dallas Mavericks, Mark Cuban, has slammed the U.S. Securities and Exchange Commission (SEC) for choosing a wrong path to regulate the crypto sector.

Many crypto proponents have criticized the SEC and its chairman, Gary Gensler, for taking an enforcement-centric approach to regulating the crypto sector. The securities regulator recently took action against major crypto exchanges, including Coinbase and Binance.

Cuban emphasized that the SEC “chose to litigate to regulate.” He stated, “You need to face the fact of the matter that crypto is one more technology that will succeed or fail based on its merits,” adding:

It’s the SEC that chose the wrong path to regulate crypto and cost billions. The SEC is not infallible. It makes mistakes. In this case, it chose the wrong course.

While many people in the crypto sector have urged the SEC to provide clear rules for crypto firms to comply with regulations, SEC Chairman Gensler has repeatedly said that the law is already clear and existing frameworks are sufficient to regulate crypto.

Gensler has also said many times that crypto lending and trading platforms should come in and register. However, Coinbase CEO Brian Armstrong insisted that he and his exchange tried to register but it was not possible to do so.

Commenting on Gensler insisting that the existing SEC regulatory framework is sufficient to regulate crypto, Cuban opined:

It was arrogant in thinking that its framework covered every possible situation.

Several Southeast Asian countries are viewed as more friendly towards cryptocurrencies compared to the U.S., resulting in a growing number of entrepreneurs leaving the country. Venture capitalist Tim Draper, famed for predicting that the price of bitcoin would reach $250K this year, for example, recently stated: “I think we’ve got a real problem because the SEC has been spreading fear and all of the innovators are leaving the country … This regulation by enforcement makes no sense.”

The Dallas Mavericks owner highlighted the contrast between the regulatory strategies of the U.S. SEC and the approach adopted by Japan’s regulator for the crypto industry. Cuban pointed out that when crypto exchange FTX crashed, “no one in FTX Japan lost money.” The Shark Tank star stressed:

If the USA/SEC had followed their example by setting clear regulations that required the separation of customer and business funds and clear wallet requirements, no one here would have lost money on FTX.

The billionaire further explained: “In Japan, they were very loud in saying the obvious, that FTX wasn’t a crypto issue, it was a fraud issue.” He detailed that the best way to prevent crypto fraud is to “Set bright-line investor protection regulations, like Japan, that detail the protections required and require registration to confirm adherence. Anyone who doesn’t register is de-facto in violation, can’t operate and will be shut down. That’s how you protect crypto investors. The SEC has it wrong.”

Last month, Cuban offered advice on how the SEC could regulate the crypto industry. He outlined the idea of implementing a crypto-specific registration process. In addition, he suggested that the SEC could develop a token registration framework to accommodate different types of tokens.